fanduel winnings tax rate|FanDuel Surpasses $1 Billion In Estimated New York Sports : Baguio FanDuel will issue a Form W-2G for each sports betting transaction when both of the following conditions are met: 1. Winnings (reduced by wager) are $600.00 or more; and 2. Winnings (reduced by wager) are at least 300 times the amount of the wager Tingnan ang higit pa The standard method commonly used for testing for E. coli is the MPN however, it does not seem adequate for juice testing because of the acidity (pH 3.6 to 4.3) of juices, which can interfere with .

fanduel winnings tax rate,We’re legally required to withhold federal taxes from sports wagering winning transactions as well as other qualifying casino game winning transactions when both of the following conditions are met: 1. Winnings (reduced by wager) are greater than $5,000.00; and 2. Winnings (reduced by wager) are at . Tingnan ang higit paThe Player Activity Statement is a summary of your FanDuel wallet and gameplay activity. It summarizes transactional movement such as deposits, withdrawals, . Tingnan ang higit pa

A Form W-2G reports gambling winnings and any income tax withheld on those winnings. Reporting and withholding requirements depend on the type of gambling . Tingnan ang higit pa

FanDuel may be required to report your activity on its Daily Fantasy Sports/Faceoff products to the IRS and applicable state taxing authorities based on the IRS Form 1099 information reporting rules. As it presently stands, FanDuel only reports activity on . Tingnan ang higit pa

FanDuel will issue a Form W-2G for each sports betting transaction when both of the following conditions are met: 1. Winnings (reduced by wager) are $600.00 or more; and 2. Winnings (reduced by wager) are at least 300 times the amount of the wager Tingnan ang higit pa Let’s get into the specifics of Fanduel taxes for a clear understanding. Firstly, it’s important to know that Fanduel follows federal guidelines when it comes to winnings. .

A federal tax hit only comes into play if your gambling winnings reach $600 or more. Also, the rate at which you’re taxed varies based on how much you win. If you use online sportsbooks like DraftKings, PointsBet, and FanDuel, you might need to pay taxes. Learn the taxes you’ll pay, how to file your sports betting . Yes, FanDuel may periodically deduct taxes from your betting account. For instance, if you win $5,000 or more and the winnings are at least 300 times the wager, a .fanduel winnings tax rate For 2023 tax returns (taxes filed in 2024), the standard deduction is $13,850 for single filers and those married filing separately, $27,700 for those married filing jointly, and $20,800 for.fanduel winnings tax rate FanDuel Surpasses $1 Billion In Estimated New York Sports For 2023 tax returns (taxes filed in 2024), the standard deduction is $13,850 for single filers and those married filing separately, $27,700 for those married filing jointly, and $20,800 for.FanDuel Surpasses $1 Billion In Estimated New York Sports Explore the intricacies of reporting FanDuel winnings on your tax return, from understanding tax withholding to tracking losses. Learn how to accurately report .

How FanDuel Winnings Are Taxed. When a player makes a bet on FanDuel and earns over $600, the platform reports it to the IRS if the odds are 300 to 1 or . How Much Tax Do You Pay on Fantasy Sports Winnings? If you win more than $600 playing fantasy sports, you will likely pay a flat 24% tax. Some fantasy sports sites and apps may even require you to .

The 51% tax rate based on those winnings would have resulted in close to $42 million in remittance to the state. The timing of the collections from the first week of . For 2023 tax returns (taxes filed in 2024), the standard deduction is $13,850 for single filers and those married filing separately, $27,700 for those married filing jointly, and $20,800 for heads .

The tax rate on gambling winnings will typically vary from state to state. The majority of states have income taxes, which means that gambling winnings are likely subject to both federal and state . Gambling winnings are subject to a 24% federal tax rate. In New York, state tax ranges from a low of 4% to a high of 8.82%. The higher your taxable income, the higher your state tax rate. A breakdown of tax rates . Gambling Win Amount. Tax Paid on Gambling Winnings. $ 0. Calculate Total After Taxes. You Keep From Your Gambling Winnings. $ 0. Note:Tax calculator assumed a standard deduction of $12,400 (single)/$24,800 (married) and does not include any municipal/local taxes. Deposit Match up to $1,000 + $25 On The House. Bonus .If your winnings are reported on a Form W-2G, federal taxes are withheld at a flat rate of 24%. If you didn’t give the payer your tax ID number, the withholding rate is also 24%. Withholding is required when the winnings, minus the bet, are: More than $5,000 from sweepstakes, wagering pools, lotteries, At least 300 times the amount of the bet. FanDuel, as a responsible payor, adheres to IRS guidelines and withholds federal tax from certain winnings. This includes winnings over $600 in a year, from off-track betting, bingo, or slot machines; any winnings over $1200 from keno games; and, all winnings over $5000 from poker tournaments. It’s important to understand the .aronnov. • 3 yr. ago. so my understanding is the current tax code sucks.. my understanding is that if you just put in $100 in your account. made thousands of bets many times over and winnings of $11,600 but your wagers were $11,000. despite only having a net profit of $600 you owe taxes on the 11,600. If you itemize your taxes (which almost .

How to Claim and Report California Gambling Winnings for Taxes. Any time you have significant gambling winnings in the state of California, the casino, track, card room or California sports betting apps, you are legally obligated to report it to the IRS.This generates a pre-filled document for the IRS known as Form W-2G which will list the . Marginal tax rate is the bracket your income falls into. The effective tax rate is the actual percentage you pay after taking the standard deduction and other possible deductions. The state income tax rate in Arizona ranges from 2.59% to 4.50%, which is the rate your gambling winnings are taxed. Bettors have a responsibility to report their . If you win a bet with extreme long-shot odds, where the payout is 300 times the wager, and you win at least $600, your winnings are reported to both your home state’s tax office and the IRS. Then, if you win $1,200 or more playing a slot machine or sports betting, your earnings are reported to the same individuals. Massachusetts taxes ordinary income at 5%. This means there is not a set gambling tax rate in MA. It will be treated differently than your income, but the rate will depend on your overall taxable income. You should keep any documentation you receive from a sportsbook, especially pertaining to a loss.

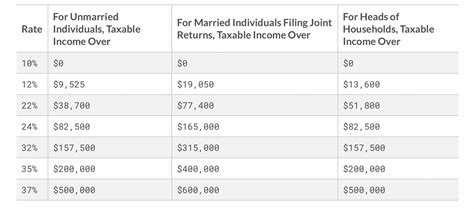

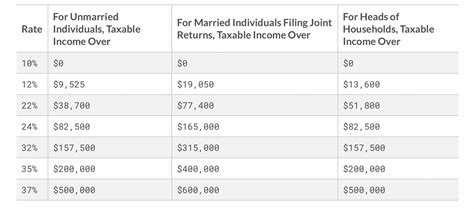

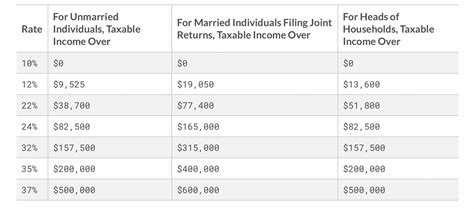

There are seven tax brackets as of 2024. You would have to have an individual income above $100,525, including your winnings, to move into the 24% tax bracket. That increases to $201,050 for . Whether it's $5 or $5,000, from the track, an office pool, a casino or a gambling website, all gambling winnings must be reported on your tax return as "other income" on Schedule 1 (Form 1040). If . The Massachusetts Senate was keen to impose a revenue tax of 35% on sports betting sites and 20% on retail sportsbooks. By contrast, the House argued for a lower revenue tax rate for sports .The state tax percentage on sports betting and casino gaming in Maryland is between 2% and 5.75%, depending on your income tax rate. Gambling winnings are also subject to a 24% federal tax. Maryland sports betting revenue is also topped up .

In Michigan, gambling winnings are subject to a 24% withholding for federal tax. That said, the actual amount you need to pay taxes on depends on your total income. If you hit a certain threshold of gambling winnings, the tax is withheld for you. Michigan has a 4.25% state income tax, and your income tax bracket needs to include your total . In most cases, winnings greater than $600 will be taxed at the standard withholding rate of 24%. Those taxes can come either at the time they are paid out by a casino/sportsbook in the form of .

Effective for tax years after 2017, the federal rate on winnings over $5,000 is 24%. Winnings under that benchmark of $5,000 must also be reported depending on their amounts and sources. Currently, Indiana’s personal income tax rate is 3.23%. Almost all gambling winnings are subject to this tax.

fanduel winnings tax rate|FanDuel Surpasses $1 Billion In Estimated New York Sports

PH0 · Understanding Fanduel Earnings Taxes: Common FAQs Answered

PH1 · Taxes on Sports Betting: How They Work, What’s

PH2 · Taxes

PH3 · Sports Betting Taxes: How to Handle DraftKings, FanDuel

PH4 · Sports Betting Taxes: How They Work, What's Taxable

PH5 · How Much Taxes Do You Pay On Sports Betting?

PH6 · How Much Are FanDuel Winnings Taxed?

PH7 · FanDuel Taxes 2023: How to Pay Taxes on Betting Winnings & L

PH8 · FanDuel Taxes 2023: How to Pay Taxes on Betting Winnings

PH9 · FanDuel Surpasses $1 Billion In Estimated New York Sports

PH10 · Effective Strategies to Handle Tax Withholding on FanDuel Winnings

PH11 · Effective Strategies to Handle Tax Withholding on FanDuel

PH12 · Are Fantasy Sports Winnings Taxable?